trust capital gains tax rate australia

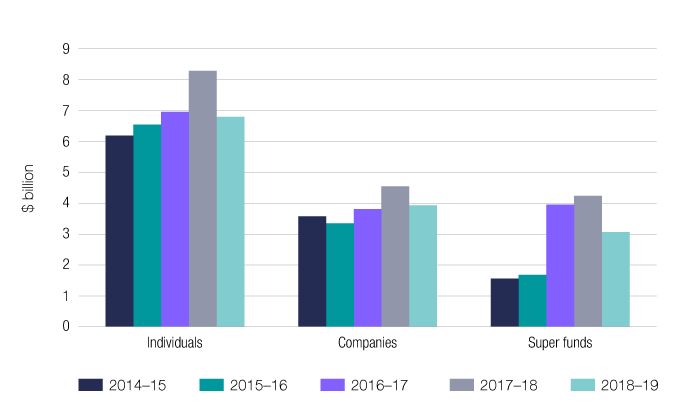

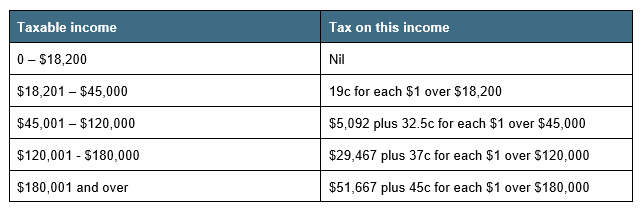

The income tax rate for companies is 30 except that companies that have less than AU 50 million of aggregated turnover which includes the turnover of affiliated and connected entities and derive no more than 80 of their income in passive forms are taxed at 26 in the 2020-2021 income year. And that net income is determined as if the trustee.

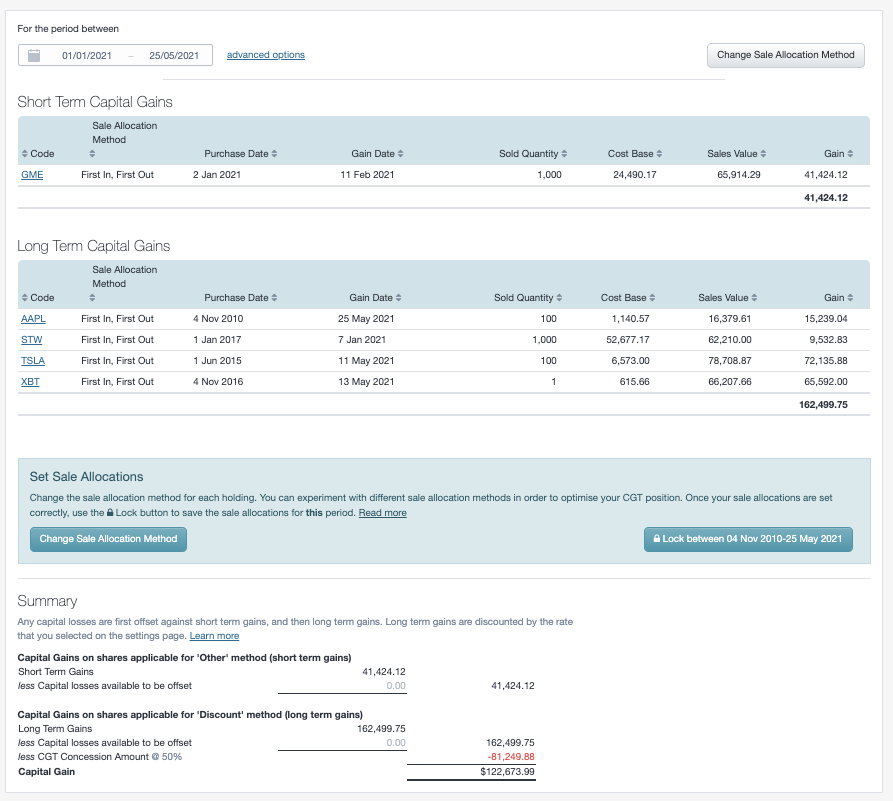

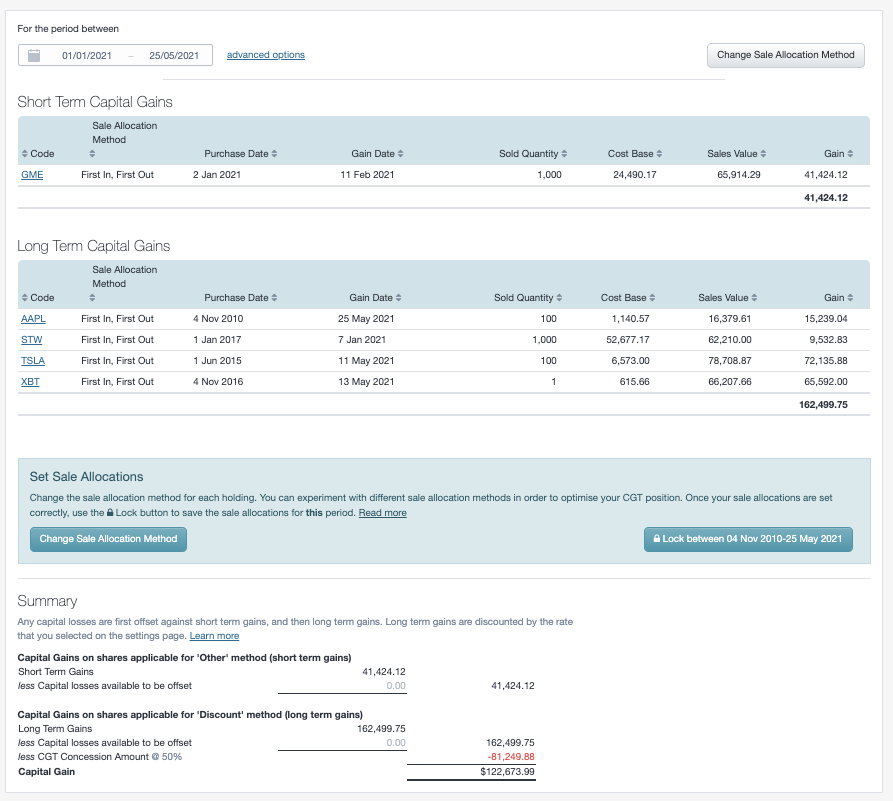

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

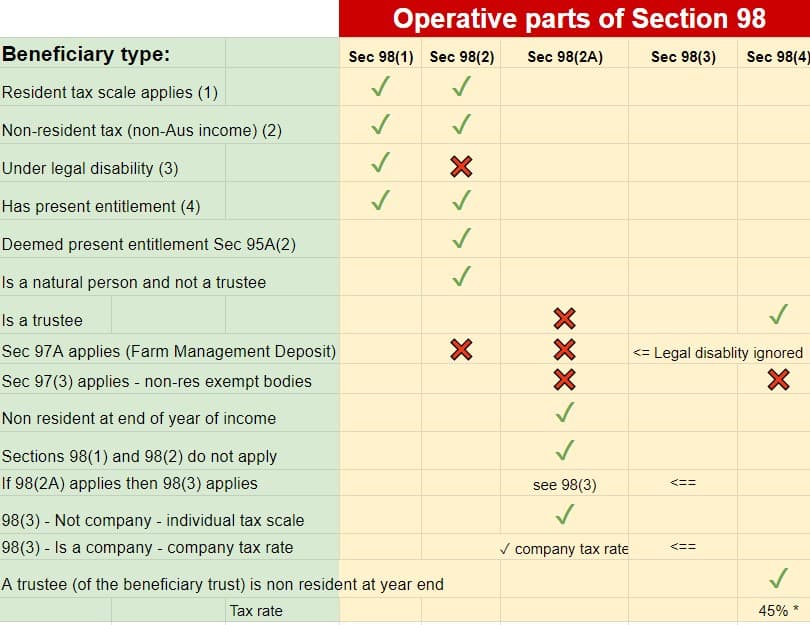

Irrespective of who pays the tax be it the beneficiaries per s97 or s98A or the trustee per s98 income tax is assessed based on the trusts net income.

. Trust capital gains tax rate australia Sunday May 29 2022 Edit. Less any capital losses. This treatment is similar to the way in which trustees are assessed in relation to a non-resident company or individual beneficiary.

This means you pay tax on only half the net capital gain on that asset. Australian resident companies that are. How Is A Family Trust Taxed In Australia Liston Newton Advisory 2022 Trust Tax Rates And Exemptions Smartasset A B.

Tax Paid by Trustees. Level 223 Foster Street. Last reviewed - 15 December 2021.

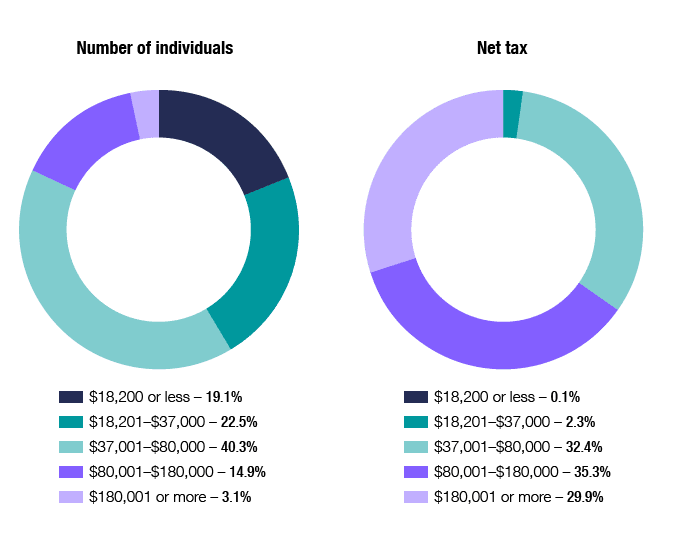

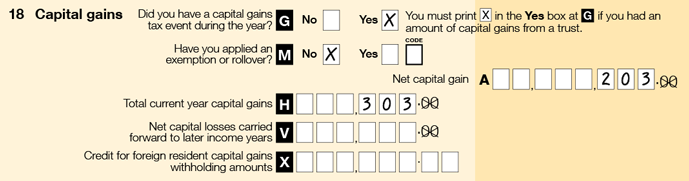

To calculate a capital gain or loss you have to determine if a CGT event has happened. 45 plus Medicare levy 15 totalling 465 and increasing to 49 for 3 years. Even though it forms part of your income tax and is not considered a separate tax it is still referred to as CGT Capital Gains Tax But if an asset is held for at least one year then any gain is first discounted by 50 per cent.

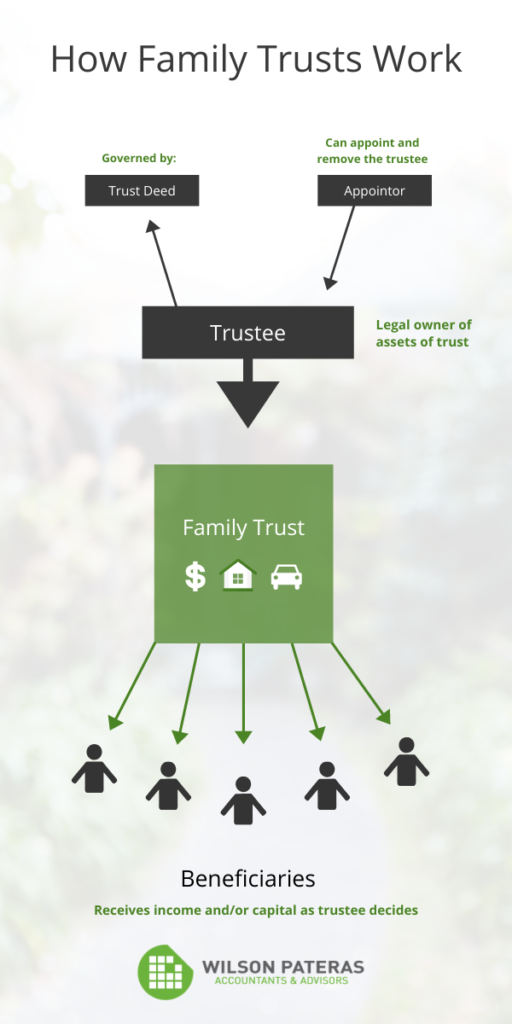

A trust is basically a structure which allows a person or company to hold an asset for the benefit of. Irrevocable trusts have a major tax issue. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

You report capital gains and capital losses in your income tax return and pay tax on your capital gains. The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

The net income of a trust effectively its taxable income is its assessable income for the year less allowable deductions worked out on the assumption that the trustee is a resident even if the trustee is actually a non-resident. If a trustee is assessed in respect of a non-resident. Companies with a turnover greater than 5000000000.

Instead the capital gain you make is added to your assessable income in whatever year you sold the property. You pay tax on your net capital gains. Will Wizard Australia Pty Ltd.

What Is A Trust In Estate Planning Trust Will 2022 Trust Tax Rates And Exemptions Smartasset Budget Basics Federal Trust Funds. Common Types Of Trusts Findlaw Matthew Ledvina Offers Us Tax Structuring Strategy Tax Return Us Tax Tax. Sections 99A and 99 tax rates are as follows.

Corporate - Group taxation. The effective tax rate on the capital gain of 10000 is 185. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate.

Understanding Tax Implications of Using Trusts. Somebody will pay tax on the net income of a trust. There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more.

Although irrevocable trusts are complex trusts which means they can accumulate income they make on trust assets the trustees normally reduce taxes by distributing all the trust income each year. As an example the most common CGT. The Income Tax Assessment Act 1936 ITAA 1936 ensures that a trustee is assessed on a non-resident trustee beneficiarys share of the net income of a trust.

For example this may occur if the trustee decides to accumulate income. What is the capital gains tax rate on a trust. Companies with a turnover less than 5000000000.

Sections 99A and 99 require that for Australian-resident trusts the trustee pays tax on the worldwide income of the trust. If there is trust income to which no beneficiary is entitled then the trustee must pay tax on that income. One of the tax advantages of a family trust is related to Capital Gains Tax CGT.

At basically 13000 in income they hit the highest tax rate. Australia Corporation Capital Gains Tax Tables in 2022. A tax consolidation regime applies for income tax and CGT purposes for Australian tax resident companies partnerships and trusts ultimately 100 owned by a single head company or certain entities taxed like a company resident in Australia.

For trusts in 2022 there are three. There is tax planning flexibility available through a trust because you can distribute income to beneficiaries. Income tax rate.

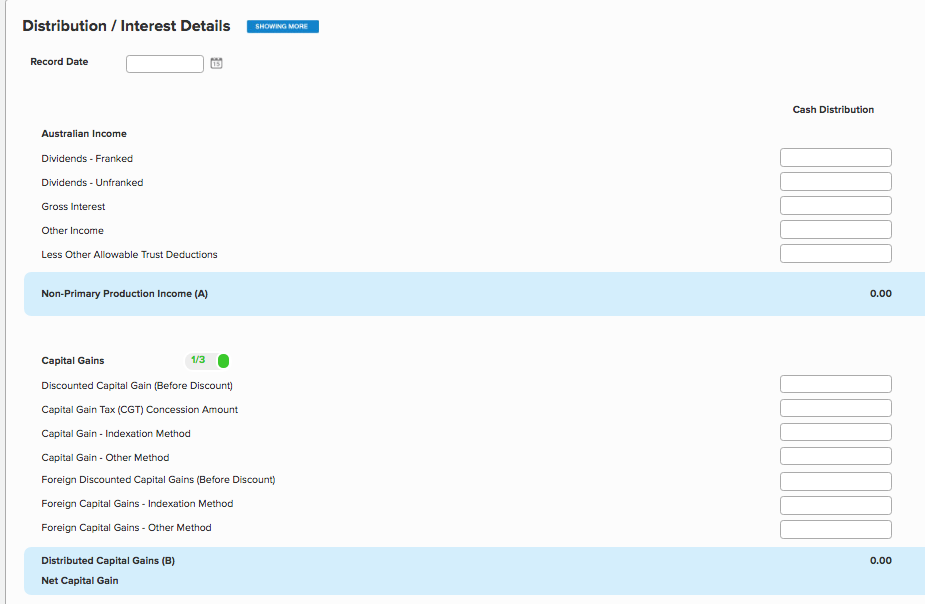

A capital gain or a capital loss will arise where a capital gains tax CGT event occurs or if another trust distributes a capital gain to you. And if non-resident the trustee pays tax only on the trusts Australian-based income. In most cases even though a CGT Event occurs you can disregard a capital gain or capital loss on an asset if the asset was acquired before 20 September 1985 known as a pre CGT asset.

By HR Block 3 min read. Few structures are as widely used but as little understood as trusts especially when it comes to the potential tax consequences which can arise where they are misused. Less any discount you are entitled to on your gains.

2022 Long-Term Capital Gains Trust Tax Rates. Surry Hills NSW 2010. This lower rate.

Because the income of a trust is determined in accordance with the trust deed and its net income is determined in accordance with tax law. Trustees must pay tax on this undistributed income at the highest marginal rate of 45. It is not a separate tax.

The capital gain or loss is generally taken into account in the trusts net capital. If you have a capital gain it will. Although it is referred to as capital gains tax it is part of your income tax.

Capital Gain Tax Rate. The tax on the capital gain would be 37. As part of the trusts net income or net loss the trust has to take into account any capital gain or loss.

Taxation of Capital Gains. That would mean that he would have a net income of 98535 a total increase of 11207 annually. Namely the 50 CGT discount.

Click here for tax rates for 2010 2011 and 2012 for both Australian residents and non-residents. However once the general 50 discount is deducted the taxpayer only declares 5000 capital gains income the tax on which at 37 is 1850. S97 98A 98that share of the net income of the trust estate.

The amount of tax you need to pay will therefore depend on the tax rates applicable to the relevant beneficiary such as an individual or a company. If you require further assistance with respect to the above or would like to know more about taxation you are welcome to contact our team of experienced tax accountants and tax lawyers by clicking here to submit an online enquiry form or call us on 1300 QUINNS 1300 784 667 or on 61 2 9223 9166 to arrange conference or appointment. Capital gains withholding - for real estate agents.

Capital Gains Tax CGT is the tax you pay on capital gains that arise from the disposal of shares. Your total capital gains. For example income distributed to beneficiaries under 18 could be taxed up to 66.

Calculating Capital Gains Tax Cgt In Australia

Capital Gains Tax On Shares In Australia Explained Sharesight

Trust Tax Rates 2022 Atotaxrates Info

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Family Trusts What You Need To Know

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

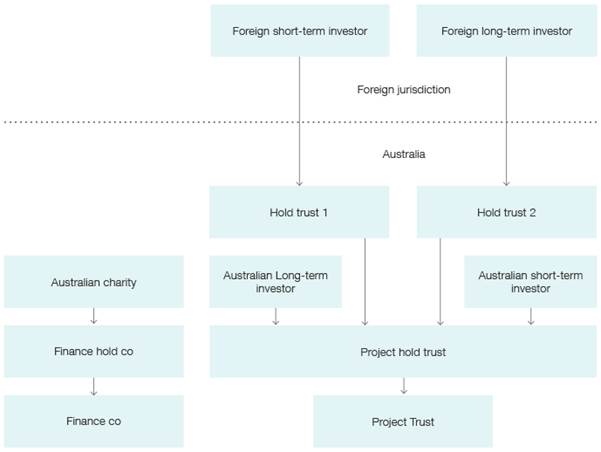

Tax Treatment Of Investors Into Ppps Australian Taxation Office

Foreign Trusts Expat Tax Professionals

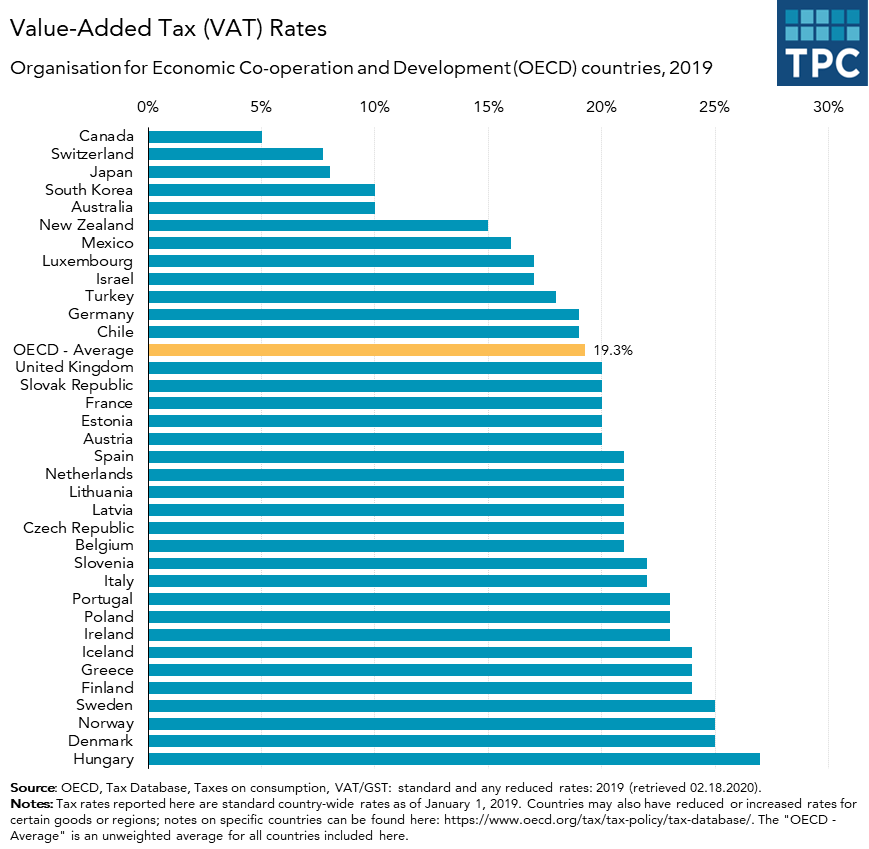

What Would The Tax Rate Be Under A Vat Tax Policy Center

/GettyImages-1164361532-0564fbe401f74f57a4a4c6c0ad02dca6.jpg)

How To Set Up A Trust Fund In Australia

How Are Dividends Taxed Overview 2021 Tax Rates Examples

End Of Financial Year Guide 2021 Lexology

Ending Tax Avoidance Evasion And Money Laundering Through Private Trusts Acoss

Non Assessable Payments From A Trust Australian Taxation Office